Our Eb5 Investment Immigration Statements

Our Eb5 Investment Immigration Statements

Blog Article

Eb5 Investment Immigration for Beginners

Table of ContentsEb5 Investment Immigration Things To Know Before You BuyThe 45-Second Trick For Eb5 Investment ImmigrationThe 10-Second Trick For Eb5 Investment ImmigrationIndicators on Eb5 Investment Immigration You Need To KnowWhat Does Eb5 Investment Immigration Do?

While we make every effort to provide exact and up-to-date material, it should not be considered lawful guidance. Migration laws and guidelines undergo change, and private scenarios can vary commonly. For personalized assistance and legal advice regarding your details migration scenario, we strongly suggest talking to a certified immigration lawyer that can give you with tailored support and make certain conformity with present legislations and guidelines.

Citizenship, through investment. Currently, since March 15, 2022, the quantity of investment is $800,000 (in Targeted Work Areas and Country Areas) and $1,050,000 elsewhere (non-TEA areas). Congress has accepted these amounts for the next 5 years beginning March 15, 2022.

To certify for the EB-5 Visa, Financiers need to develop 10 full-time U.S. jobs within two years from the day of their full investment. EB5 Investment Immigration. This EB-5 Visa Need ensures that financial investments contribute directly to the U.S. task market. This applies whether the jobs are created directly by the company or indirectly under sponsorship of a marked EB-5 Regional Center like EB5 United

Our Eb5 Investment Immigration Statements

These work are identified through versions that utilize inputs such as development prices (e.g., construction and tools expenses) or annual profits generated by recurring procedures. In comparison, under the standalone, or direct, EB-5 Program, only direct, full time W-2 worker settings within the company may be counted. A key risk of counting only on straight workers is that team reductions as a result of market conditions might result in insufficient full-time positions, possibly resulting in USCIS denial of the financier's request if the task production requirement is not fulfilled.

The financial design after that projects the variety of direct work the brand-new company is likely to develop based upon its awaited earnings. Indirect work determined with financial models describes employment created in industries that provide the goods or services to business directly associated with the project. These jobs are produced as an outcome of the raised need for items, materials, or services that sustain business's operations.

Everything about Eb5 Investment Immigration

An employment-based fifth preference classification (EB-5) financial investment visa supplies a technique of coming to be a permanent U.S. local for international nationals wishing to her comment is here spend capital in the United States. In order to make an application for this environment-friendly card, an international investor needs to spend $1.8 million (or $900,000 in a Regional Facility within a "Targeted Employment Location") and produce or preserve at useful content the very least 10 permanent jobs for United States workers (leaving out the investor and their instant household).

This measure has actually been a remarkable success. Today, 95% of all EB-5 capital is raised and spent by Regional Centers. Considering that the 2008 monetary crisis, accessibility to capital has actually been restricted and community budgets proceed to deal with significant shortages. In lots of areas, EB-5 financial investments have filled up the financing void, providing a new, crucial resource of capital for neighborhood economic development projects that rejuvenate communities, produce and support jobs, infrastructure, and services.

Eb5 Investment Immigration Things To Know Before You Buy

employees. Furthermore, the Congressional Budget Workplace (CBO) racked up the program as earnings neutral, with Recommended Reading administrative expenses paid for by candidate costs. EB5 Investment Immigration. Greater than 25 nations, consisting of Australia and the UK, use comparable programs to attract international investments. The American program is more stringent than lots of others, calling for significant danger for investors in regards to both their monetary investment and immigration standing.

Family members and individuals who look for to relocate to the United States on a permanent basis can use for the EB-5 Immigrant Financier Program. The United States Citizenship and Immigration Solutions (U.S.C.I.S.) established out numerous requirements to get permanent residency through the EB-5 visa program.: The very first step is to find a qualifying investment opportunity.

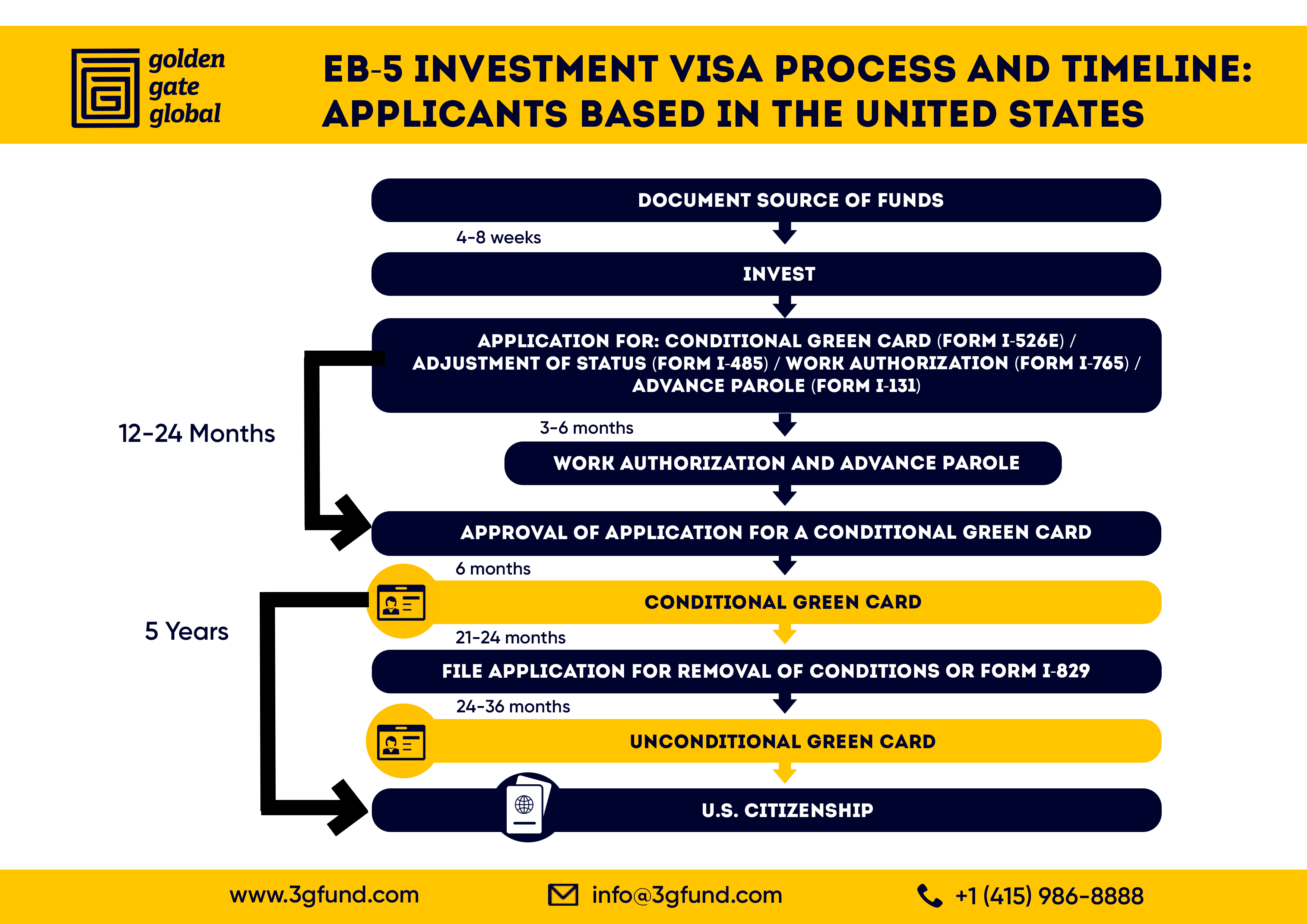

When the possibility has actually been recognized, the investor needs to make the financial investment and send an I-526 petition to the U.S. Citizenship and Migration Provider (USCIS). This application should consist of evidence of the financial investment, such as bank statements, purchase arrangements, and business strategies. The USCIS will certainly evaluate the I-526 petition and either authorize it or demand extra evidence.

Eb5 Investment Immigration Can Be Fun For Everyone

The capitalist should make an application for conditional residency by submitting an I-485 petition. This request should be sent within six months of the I-526 authorization and need to include proof that the investment was made which it has produced at the very least 10 permanent jobs for united state workers. The USCIS will certainly review the I-485 application and either authorize it or request extra evidence.

Report this page